Table of Content

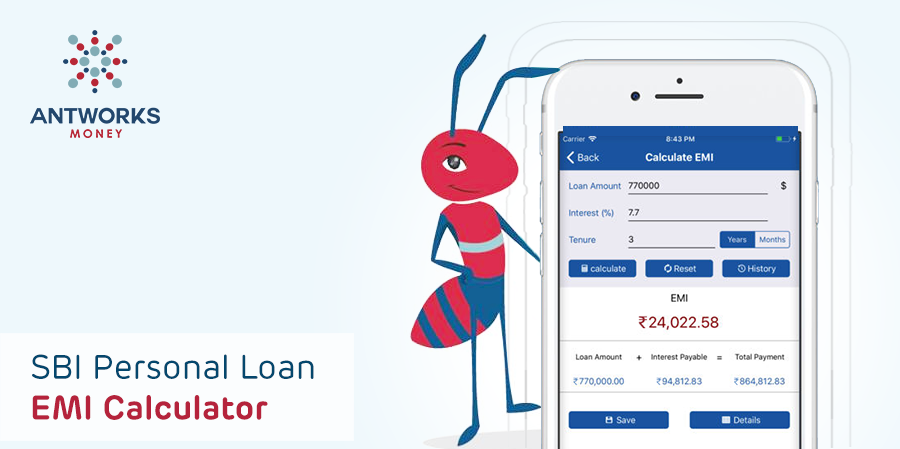

Refer to the bank to get the interest rate estimate and then calculate the EMI of different loan amounts and tenure. It can help with finding the loan amount and tenure with the lowest EMI. The borrower can use the SBI Home Loan EMI Calculator to calculate this EMI amount before the EMI payments begin or even before taking the loan. The calculator has a specific algorithm that calculates the EMI value and is always accurate with its results.

Fill in your personal, financial, professional and property related details as required and submit the application. Improve your credit score– Being disciplined with your finances lead to a better credit score. A good score is generally above 700, and getting a good score will improve your chances of getting a Home Loan at a low rate. It is best to opt for an SBI home loan prepayment during the initial years of the loan.

Home Loan EMI Calculator - SBI

The eligibility criteria for women are the same as for other applicants although women borrowers are given an interest rate concession of 05 basis points. A home is one of the first things people think of buying, in their youth – how they want it to look like, what are things they will have in the house etc. But as they get older, they realize that to make this dream of theirs come true they need money which is not easy to save with the current economy and inflation crisis. It is to help this goal of people, to buy their dream homes that banks and NBFCs offerhome loans. An SBI home loan EMI calculator can come in handy to customers who wish to take a home loan from The State Bank of India. Optfor a longer tenure– Choosing a longer loan tenure will lower your Home Loan EMI amounts and make it easier for you to handle every month.

You can avail pre-approved loans from SBI through their YONO App. It is to be noted that only pre-selected applicants who check off certain parameters are eligible to avail of this option. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. For example, let’s consider you have availed a home loan of Rs. 60 Lakh at 9% (0.75% per month) rate of interest with tenure of 20 years .

Crop Loan

The SBI home loan calculator provides an option to compare multiple EMIs, which may vary because of different combinations of the loan amount, interest rate and tenures the borrower may log into the calculator. This allows the borrower to discover an EMI amount that aligns with their budget. Use the Loanbaba EMI calculator on this page to understand the suitable tenure and EMI amount. However, each month, the principal repaid and interest payment proportion will be different in every EMI.

With the hike in MCLR, any loan linked to it will see an increase in interest rates which means EMIs for a range of loan products could also go up for both current and new customers. With floating rates, the interest rate of the home loan will change. If the repo rate increases, then both the interest rate and EMI will increase.

Eligibility Calculation for SBI Home Loan

Loan amount– This is the amount you want to borrow to fulfil your home needs. Home loan amount mainly depends on value of the property for which the loan is availed. Generally, the tenure for a home loan ranges from 15 years to 30 years. You can also negotiate a bit on the rate with the loan provider. It gives you an accurate approximate, which is crucial for financial planning.

Please locate us and contact us for your home loan requirements. As you repay the loan with interest, the proportion of principal repayment will increase, and interest component will reduce. While calculating the EMI for a loan, you should know the amount which you will have to pay when you take up a loan of the said amount, the tenure, and also the interest rate.

Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount. The longer the tenure of the loan, the lesser will be the EMI amount. Thus, if the borrower takes a loan of 30 years then, compared to a 5-year loan, the EMI will be lower. Since, the EMIs are paid every month, the duration is calculated in the number of months.

In practice, a shorter tenure results in higher EMIs, but helps you save on the total interest payout of the loan. Longest loan tenure available across banks and NBFC’s in India for buying a home on a loan is around 30 years, subject to borrower’s current age and retirement age. The SBI bank does not charge any extra fees for opting for prepayment in case of a floating interest rate. The decision to change the loan tenure or the SBI Home Loan EMI Calculator EMI is for the borrower to choose in case of prepayment. State Bank of India is a financial and banking service provider.

The SBI Home loan calculator gives you an accurate brief on monthly EMI payments. Your monthly instalment towards repayment of a housing loan must suit your pockets. Remember that delaying or missing payments will affect your credit score. Thus, it is important to understand your loan requirements and calculate the EMI amount, to know the ideal tenure for the loan. Part-payment of SBI home loan also facilitates in improving the borrower's credit score.

Similarly, if the repo rate decreases, then the interest rate and EMI will also decrease. So, to calculate the EMI using SBI Home Loan EMI Calculator, check with the SBI bank to find the current interest rate. The online SBI Home Loan EMI Calculator provides an accurate estimate of the EMI amount that needs to be paid to clear eth debt. Knowing this amount beforehand can help with planning the monthly budgets and see if the borrower will be able to pay the amount timely without any defaults.

The loan amount depends on the financial status of the borrower, their age, the loan tenure, etc. The borrower can use the SBI Home Loan EMI Calculator to further calculate the EMI for any loan amount and tenure. The SBI home loan calculator will help you calculate the total monthly EMI and interest amount you would have to bear even before applying for the loan. The calculator helps you to plan your repayment process in advance. It clarifies to the borrower to assess and determines monthly EMIs they’ll bear against the loan.

No comments:

Post a Comment